Yearly depreciation formula

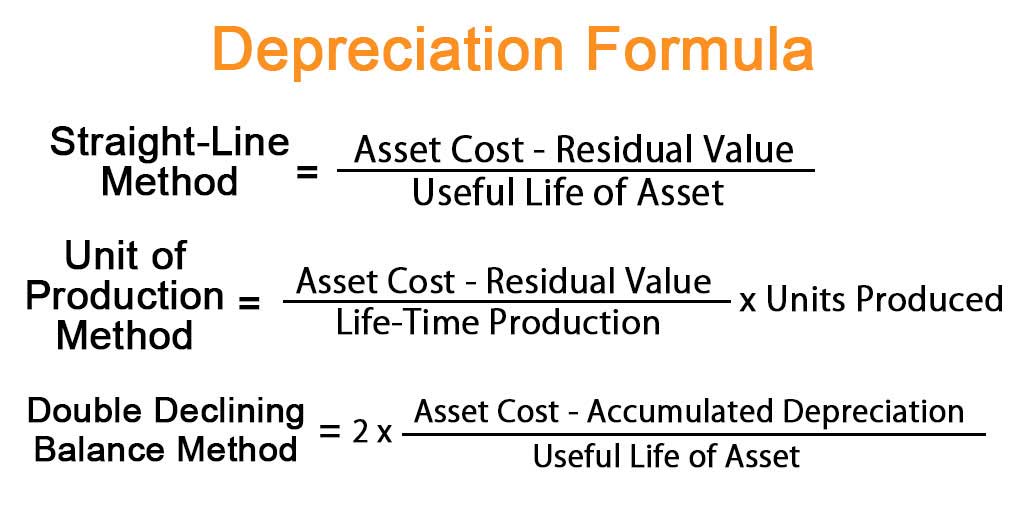

Depreciation per year Asset Cost - Salvage Value Useful life Declining Balance Depreciation Method For specific assets the newer they are the faster. Depreciation Expense Total PPE.

Straight Line Depreciation Formula Guide To Calculate Depreciation

This rate is consistent from year to year if the straight-line method is used.

. The syntax is SYD cost salvage life per with per defined as. The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method. The following is the formula.

In period 9 Depreciation Value DDB 33554. The SYD function calculates the sum - of - years digits depreciation and adds a fourth required argument per. Fixed assets lose value over time.

Instead of measuring depreciation using dollars it measures it in units of production. Depreciation Value Straight Line is not higher so we do not switch. This is known as depreciation and it is the source of depreciation expenses that appear on corporate income statements and balance sheets.

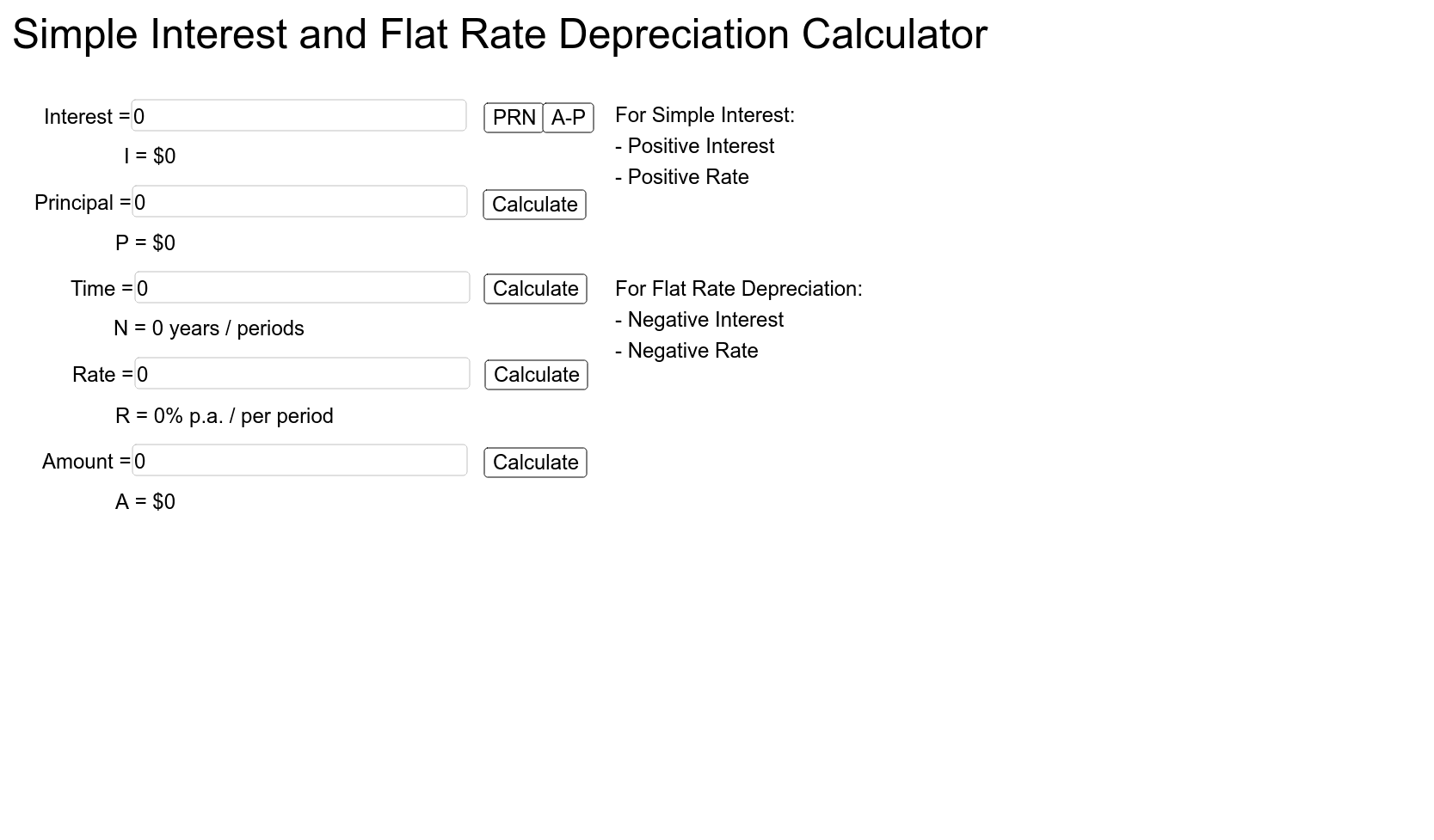

Annual depreciation is the standard yearly rate at which depreciation is charged to a fixed asset. The formula for current appreciation value looks like this. This depreciation calculator is for calculating the depreciation schedule of an asset.

This article describes the formula syntax and usage of the SYD function in Microsoft Excel. It provides a couple different methods of depreciation. Annual Depreciation Cost of Asset Net Scrap ValueUseful Life Annual Depreciation 10000-10005 90005 1800year Annual Depreciation Rate Annual.

You can use the following double-declining balance depreciation formula to determine the accumulated depreciation for years. Dollar amount Final value - Initial value Change in value in dollars Percentage Change in value Initial investment 100. Number of Periods in Year Year End - Begin Depr Date 6 12312006 - 7012006 Percentage Depreciation for Year Number of Periods in YearRemaining Life 10 6 60 Yearly.

For example the first-year. Total yearly depreciation 2 x Depreciation. Returns the sum-of-years digits depreciation of an asset for a specified period.

Depreciation Amount Straight-Line x Depreciable Basis. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. First one can choose the straight line method of.

Accumulated Depreciation is calculated using the formula given below Accumulated Depreciation Cost of Asset Salvage Value Life of the Asset Noof years For 2nd Year Accumulated. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. The unit-of-production method is similar to straight-line depreciation except for one thing.

We still have 167772 - 1000 see first picture bottom half to depreciate. The depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset.

A Complete Guide To Residual Value

Car Depreciation Calculator

Declining Balance Depreciation Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

Annual Depreciation Of A New Car Find The Future Value Youtube

Macrs Depreciation Calculator With Formula Nerd Counter

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Rate Formula Examples How To Calculate

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

Straight Line Depreciation Formula And Calculation Excel Template

Accumulated Depreciation Definition Formula Calculation

Depreciation Calculation

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Formula Calculate Depreciation Expense

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Rate Calculator Flash Sales 51 Off Www Ingeniovirtual Com